Traders Solution offers you complete and in-depth solutions for setting-up an IFSC Broker License during Belize (Central America). We will assist you with every step of the way to ensure your integrity and confidence during Belize Forex Company Formation. Our complete package offers you, all the mandatory requirements for a successful registration of Belize Broker License and in-depth compliance with the IFSC (Belize).

IFSC, Belize is a regulatory body holding responsibilities of issuing, renewing and regulating Belize Forex Broker License that is usually issued to finance based companies which intend to expand its base or engage in full fledge FX trading activities. This company is required to comply with the rules and standards set by regulatory body which includes the adequacy ratio and operation based activities.

Most of the countries will not allow Forex trading as legit rather they try to cover in such a way that holds the blanket license which serves into trading in other different financial services arena. The most important factor is that Belize is considered an FX licensing hub because it is relatively cost effective and less time consuming as compared to other Forex regulatory bodies. Belize is well established and highly regulated jurisdiction that allows you to open a bank account for Forex based services. It is one of the preferred choices for setting up a Forex and security brokerage firm.

Passport copy should be mandatorily notarized while the text should be in English language.

Last 3-months utility bill (attached with original Copy)

Director’(s) or shareholder’(s) letter with bank account statement

The copy of educational degree certificate should be in English

Note: All of the documents should have 2 copies, 1st will be submitted to the IFSC, while another one will be duly submitted to the respective Bank for account-opening purpose

Application Form by IFSC, Belize.

Affidavit of directors’ bio data.

Bank application forms.

AML Procedures.

Business Plan.

5-year financial forecast.

Balance sheet with forecast description.

AML/CFT FAQ’s Declaration.

Note: The ad-hoc additional documents maybe requested from any authority or institution during the process.

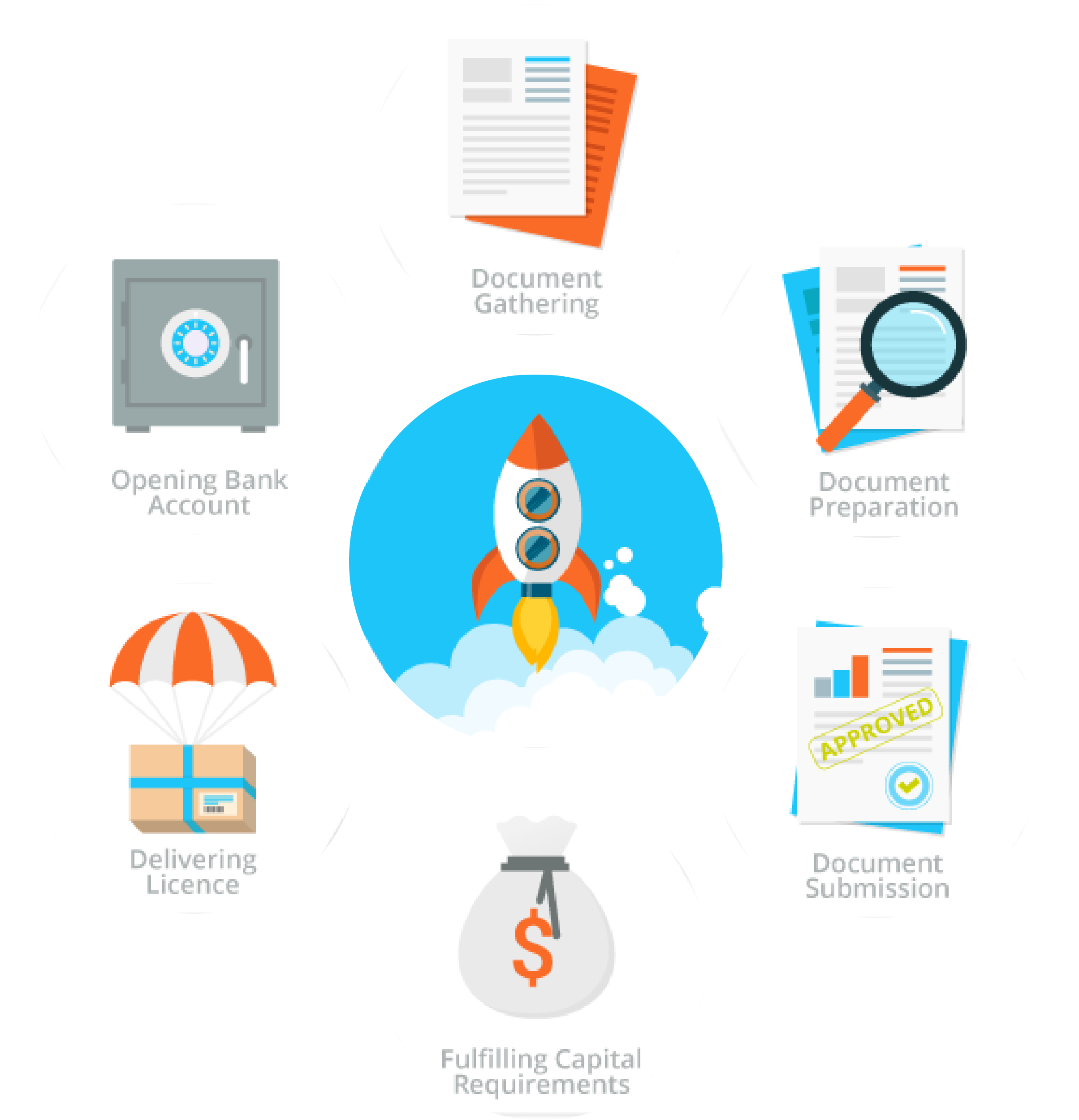

To begin with, we gather and prepare all the documents, including due diligence

Registration as Belize Company with paid up capital over $500,000. It also includes a specific company with 100,000 shares with virtual company address.

Preparation of AML procedures and custom suited business plan

Account opening in a local bank for satisfying paid up capital requirements. This includes preparation and submission of all the bank forms, corporate documents and due diligence documents.

Submission of all required corporate documents and business plans to the IFSC in order to start with application of the process.

Ad-hoc support and provision of minor documents required during the process

Deposit of funds at a local bank account in order to satisfy capital requirement for the IFSC.

Open a corporate A/C in EU bank for operational needs.

Receipt of license from the IFSC and delivery of documents to the clients.

Fanalizing bank account opening in the EU bank and delivery of documents to the client.

Deposit

Minimum Initial Deposit

License Renewal

Required Amount(in $)

$ 5,00,000

$ 25,000

A Belize IBC is not subject to any taxes in Belize regardless of the source of the revenue generated.

It provides protection against frivolous lawsuits separating ownership from personal individual liability

Directors or shareholders not required to file their personal information on public record. An IBC register of shareholders is available for inspection only by shareholders or by order of the Belize Courts at the request of any shareholder.

Public filing requirement include a Memorandum (MOA) and Articles of Association (AOA) only.

A Belize IBC is used to maintain offshore bank accounts, for commercial trading, that hold investments in offshore securities that act as corporate trustee, to own shares in other companies, to own intellectual property, factoring, to own real estate outside Belize, and to own ships.

IFSC Belize, by permitting you to operate a Forex Brokerage Firm, offers your clients the option to make their own trades via an online trading platform and to open their own trading accounts with your company.

Huge amount of flexibility as only one director and one shareholder are required, with varying share trading options.

No information-exchange agreements with any of the foreign counter parties, even on grounds of suspected tax evasion, ensuring client confidentiality. Belize is one of the most secure and confidential offshore jurisdictions.

One of the primary advantages of IFSC is confidentiality; it involves ensuring freedom of individual and the solemnity of private and commercial transactions. The MOA & AOA are the only document presented for public filing at the Registry. No requirement for public disclosure or annual filing of accounts, The FIU of Belize and the IFSC, Belize are the only organizations that have access to a client’s information upon request.